The current selling environment is complex. As Gartner has shown there are often 7+ buyers in the B2B sales process and vendors participate in less than 20% of the entire buying process. All of this means less opportunity for quality conversation and more potential for misunderstanding.

A key mistake many teams make in the current environment is using a sales approach that relies too heavily on either the buyer voice or the seller voice. In reality, successful selling in this environment requires the right balance of both.

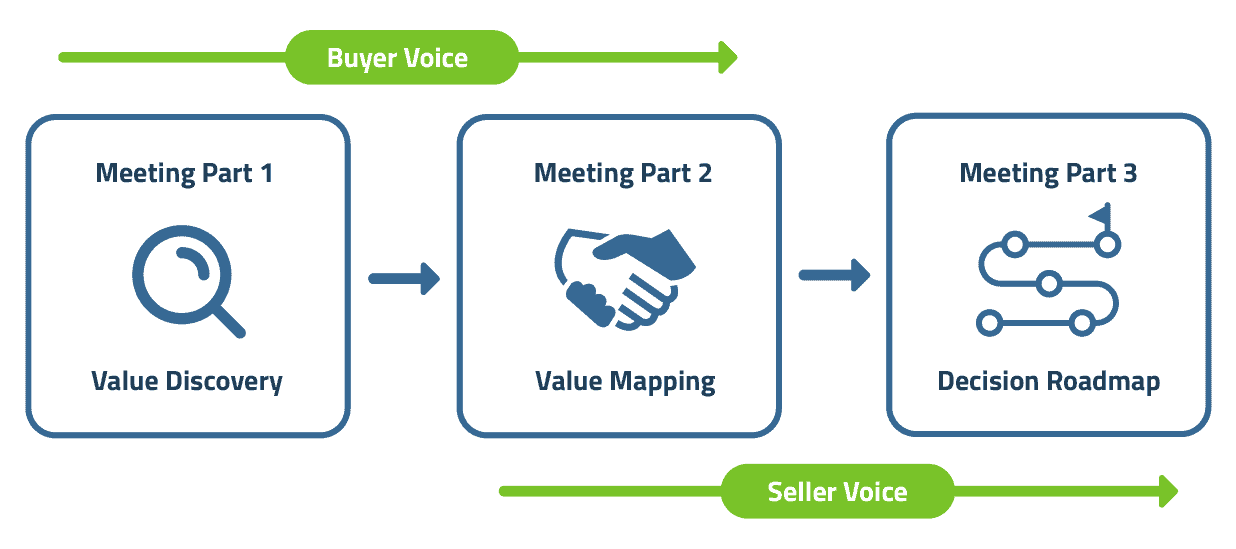

At the beginning of the sales process, we need to focus on drawing buyers out, centering on the “buyer’s voice” with the right value discovery to let the buyer share their goals, gaps, and payoffs. This discovery process helps the seller find the pathway to buyer value or value pathway that solves a critical buyer goal. Once we understand what the buyer values, we need to shift to the “seller’s voice” to lead the process forward with value mapping to our capabilities and impacts, and building a decision roadmap to move the conversation forward. Achieving this balance is the key to unlocking a buyer value pathway.

Buyer’s Voice vs. Seller’s Voice

Over the last decade, you have seen a proliferation of selling methodologies that center on either the buyer’s voice or the seller’s voice.

Examples of the methodologies focused on the buyer’s voice include:

- Consultative selling which starts with a hyper-focus on the customer rather than the product being sold with dialogue to identify and provide solutions to a customer’s needs.

- Customer-centric selling that elevates your customer and empathizes with their needs in every stage of the sales process with the seller serving as the customer’s greatest problem-solving ally.

- Value-based selling in which sales reps focus on taking a consultative approach to the customer so the sales decision is made based on the potential value the product can provide.

On the other side of things, examples of methodologies that focus on the seller’s voice include:

- Challenger selling that relies on delivering insight about an unknown problem or opportunity in the customer’s business that the supplier is uniquely positioned to solve and focuses on exposing flaws or misinformation in current thinking to present a better course of action.

- Disruptive Selling that helps companies to transform to the new age of selling using disruptive concepts to engage and empower customers.

- Provocative Industry Insight that supports engaging C-level and VP-level executives by pointing out “unconsidered needs” or missed opportunities the executive doesn’t know they have or don’t fully appreciate.

The reality is that to be a top team in the current environment you need to master approaches to both the buyer and the seller voice. As Aberdeen showed powerfully in their 2015 study “Selling Tools of the Trade: What are the Must-Haves?” it is neither understanding buyer’s needs nor presenting compelling insights that leads to Best-in-Class sales performance but the intersection of the two in mapping products and services to prospects’ business challenges.

Value Discovery First, Buyer’s Voice

“Telling is not selling” is a colloquial way of saying the first part of any sales meeting needs start with the buyer’s voice. Whether a first, second, third or fourth call, we need to start each call with discovery, re-discovery, or confirmation of our buyer’s critical goals. The fastest path to a high velocity deal is the buyer starting to envision an “alternative future” as they hear themselves talk through their goals as well as gaps and payoffs from goal achievement.

We talk about this process of leveraging the buyer’s voice to guide toward an alternative future as value discovery. In an earlier post we outlined a process for Value Discovery. Here we want to emphasize several key rules for good value discovery:

- Lead with goals, not pains

Leading with a pain or problem can quickly put a buyer on the defensive and put you as the seller into the “just trying to sell me something” category. By contrast, starting with the buyer’s goals, asking about gaps to goal achievement or sharing common gaps from work with peers starts the conversation in collaborative, “trusted advisor” mode.

- Guide with questions

Questions are the best way to lead the buyer and the conversation toward an actionable sales opportunity. But, it is not open-ended questions, rather it is guided questions that lead the buyer towards the goals we have customers solve, key capabilities that advance these goals, and payoffs to partnering.

- Use gap questions as “teasers”

A key element of good discovery is that goal and gap questions are both nested into our discovery questions. Our gap questions should act as “teasers” around our key capabilities and play a central role in pointing the buyer to an alternative future. The gaps questions show an ideal state that becomes possible if they adopt our product or solution set.

Andy Raskin, in one of the most compelling posts ever on sales strategy (The Greatest Sales Deck Ever), describes this process of using questions, not product, to guide the prospect to an alternative future:

“It’s tempting to jump into the details of your product or service. Resist that urge. If you introduce product/service details too soon, prospects won’t yet have enough context for why those details are important, and they’ll tune out. Instead, first present a “teaser” vision of the happily-ever-after that your product/service will help the prospect achieve.”

Value Mapping Second, Seller’s Voice

When we have established the buyer has a critical goal with a known gap or desired improvement and see the buyer lean into a “teaser” on an alternative future state, then it’s time to shift to the seller’s voice and present how our capabilities will move the buyer towards their critical goal.

We refer to this shift to leading with seller’s voice as Value Mapping, which has three key rules:

- Map capabilities to goals and gap resolution

We need to link our product discussion and demo directly back to the buyer’s goals and payoffs using language like “I heard you say,” “I understand your goals to be,” “You mentioned focusing on,” and so forth. Anchoring our product discussion to goals keeps buyers engaged and interested.

- Present evidence of impact

A second key piece of value mapping is presenting evidence that your capabilities will have the buyer’s desired impact. It is not enough just to claim impact, you need to demonstrate it. By far, the most effective type of evidence is a success story about another customer you have already helped achieve the desired results. The closer alignment in the success case the better in terms of use case and market segment alignment. Another type of evidence comes in the form of proxy payoff statements that capture a typical business percentage (%) or dollar ($) or efficiency impact or outcome across representative buyers.

- Secure buyer confirmation

A third key piece of value mapping is securing buyer confirmation. Often sellers discuss and demo product capabilities or describe success cases without ever stopping to confirm that the buyer actually sees how we can move them to move towards their goals or end state. At several points in the capabilities discussion, we should stop and ask our buyer “how would you see our capabilities resolving your gap to goal? Or moving you toward a desired improvement? Or moving you forward?”

The Corporate Executive Board’s Sales Practice, now part of Gartner, describes value mapping as prescriptive selling. They did a 2017 study comparing prescriptive and responsive selling and found the prescriptive approach had dramatic improvements for both buyers and sellers:

“Whereas the responsive approach typically depressed purchase ease, a proactive, prescriptive approach increased purchase ease by 86%. Prescriptive suppliers give a clear recommendation for action backed by a specific rationale; they present a concise offering and a stable view of their capabilities; and they explain complex aspects of the purchase process clearly…Suppliers that make buying easy are 62% likelier than other suppliers to win a high-quality sale.”

Pivoting to a prescriptive seller’s voice can have dramatic impacts, but only when it follows deep value discovery that allows the buyer to build their target and bullseyes for us. In the absence of that discovery, our prescriptions can quickly miss the mark.

Decision Roadmap Third, Seller’s Voice

The other key area where the seller needs to lead is in building the decision roadmap. As we covered in a previous post on Three-Part Meetings the last part of any sales meeting should be used to gauge the buyer’s readiness to take steps to build organizational support to purchase.

This starts with confirming if the buyer sees a fit between their goals, gaps-to-goal achievement and our capabilities. If the buyer confirms fit, then the more actions a buyer is willing to take to bring in other decision-makers, to explore funding and timeline options, to build a business payoff, the more qualified the deal. It is these “hard questions” around buyer commits that usually do not receive enough air time, but are the most important in qualifying the deal.

We will go into more detail about how you can build “buyer gets” and decision roadmap questions in this post on Forecast Accuracy: It’s All About the Buyer Gets.

Assessing Your Value Mapping: A Simple Self-Diagnostic

Here are a few questions you can ask yourself as you work to connect strong seller discovery work that identifies clear value pathways to proactively mapping a way forward for a buyer:

- Have you mapped your major product capabilities to the key business goals and payoffs?

- Have you developed short spoken success cases that can be organized into a sales pitch? Are these success cases organized to easily map to a prospect’s business goal, segment or sector?

- Have you developed proxy payoff statements that capture a representative business impact?

- Have you helped your team develop and practice mapping statements that link capabilities to buyer goals? Or confirmation questions to confirm the capabilities discussion?