Retail Industry

Accelerate revenue by connecting to issues driving urgency for Retail B2C buyers.

According to PWC, 43% of consumers plan to increase online shopping in the next six months. E-commerce grew massively during the pandemic but while the boom is subsiding, the long-term trend continues.

Since the pandemic, CPG and retail companies have struggled to keep pace with the dramatic shift to e-commerce and omnichannel sales.

Trusted by these Retail clients:

Retail Industry Buying Theme #1

Omnichannel Experience

While the pandemic accelerated the trend toward e-commerce, consumers say they want a hybrid shopping experience.

![]() 75% of US consumers engage in omnichannel activities, doing their research and making purchases both online and in offline channels.

75% of US consumers engage in omnichannel activities, doing their research and making purchases both online and in offline channels.

![]() Consumers expect to be able to interact with a brand via mobile and social channels – Gartner predicts the metaverse is the next horizon

Consumers expect to be able to interact with a brand via mobile and social channels – Gartner predicts the metaverse is the next horizon

![]() Flexible payment options are in demand, such as buy now, pay later options

Flexible payment options are in demand, such as buy now, pay later options

Key Takeaway: While many retailers now take a digital-first approach, it’s not an either-or proposition. Investments to innovate and integrate across channels are needed to meet new consumer expectations.

Key Takeaway: While many retailers now take a digital-first approach, it’s not an either-or proposition. Investments to innovate and integrate across channels are needed to meet new consumer expectations.

Retail Industry Buying Theme #2

Personalized Commerce

57% of CFOs say they will increase investment in customer analytics to make real-time and more tailored recommendations.

![]() Social media is a major driver of online sales with creative social and micro-influencers playing as large a role as traditional advertising

Social media is a major driver of online sales with creative social and micro-influencers playing as large a role as traditional advertising

![]() In-store services like personal shoppers are increasingly popular

In-store services like personal shoppers are increasingly popular

![]() Gartner predicts that a majority of consumers will withhold critical data from marketers going forward, despite their desire for personalization

Gartner predicts that a majority of consumers will withhold critical data from marketers going forward, despite their desire for personalization

Key Takeaway: Personalization is still king across channels, despite increasing data privacy concern. Retailers can differentiate if they create unique and memorable personalized experiences.

Key Takeaway: Personalization is still king across channels, despite increasing data privacy concern. Retailers can differentiate if they create unique and memorable personalized experiences.

Retail Industry Buying Theme #3

A Challenging Labor Environment

Seven in 10 executives surveyed said labor was the number one challenge heading into 2023.

![]() Hiring and retaining staff remains a top concern with 879,000 US retail jobs remaining unfilled as of November 30, 2022.

Hiring and retaining staff remains a top concern with 879,000 US retail jobs remaining unfilled as of November 30, 2022.

![]() 45% of retailers plan to invest in self checkout and other automations delivering better customer experience that also helps employees

45% of retailers plan to invest in self checkout and other automations delivering better customer experience that also helps employees

![]() Retail executives identified labor costs as the second most critical risk for 2023, potentially affecting profitability targets

Retail executives identified labor costs as the second most critical risk for 2023, potentially affecting profitability targets

Key Takeaway: Companies need a differentiated employee experience and must invest in a talent strategy to meet their strategic business objectives.

Key Takeaway: Companies need a differentiated employee experience and must invest in a talent strategy to meet their strategic business objectives.

Retail Industry Buying Theme #4

De-Risking the Supply Chain

Supply chain worries linger after last year’s crisis, with CPG execs again rating supply chain risk as their top concern for 2023

![]() 46% of companies plan tech investments for supply chain visibility

46% of companies plan tech investments for supply chain visibility

![]() Many retailers are expanding use of micro fulfillment centers near residential areas to optimize customer deliveries

Many retailers are expanding use of micro fulfillment centers near residential areas to optimize customer deliveries

![]() Consumers want to know about delays. In fact, 70% are less likely to do business with a retailer that doesn’t inform them of delays.

Consumers want to know about delays. In fact, 70% are less likely to do business with a retailer that doesn’t inform them of delays.

Key Takeaway: Retailers are planning a range of responses to their supply chain challenges, leading with increased investments in supply chain technology. Visibility is a top goal for both retailers and consumers.

Key Takeaway: Retailers are planning a range of responses to their supply chain challenges, leading with increased investments in supply chain technology. Visibility is a top goal for both retailers and consumers.

Success Story

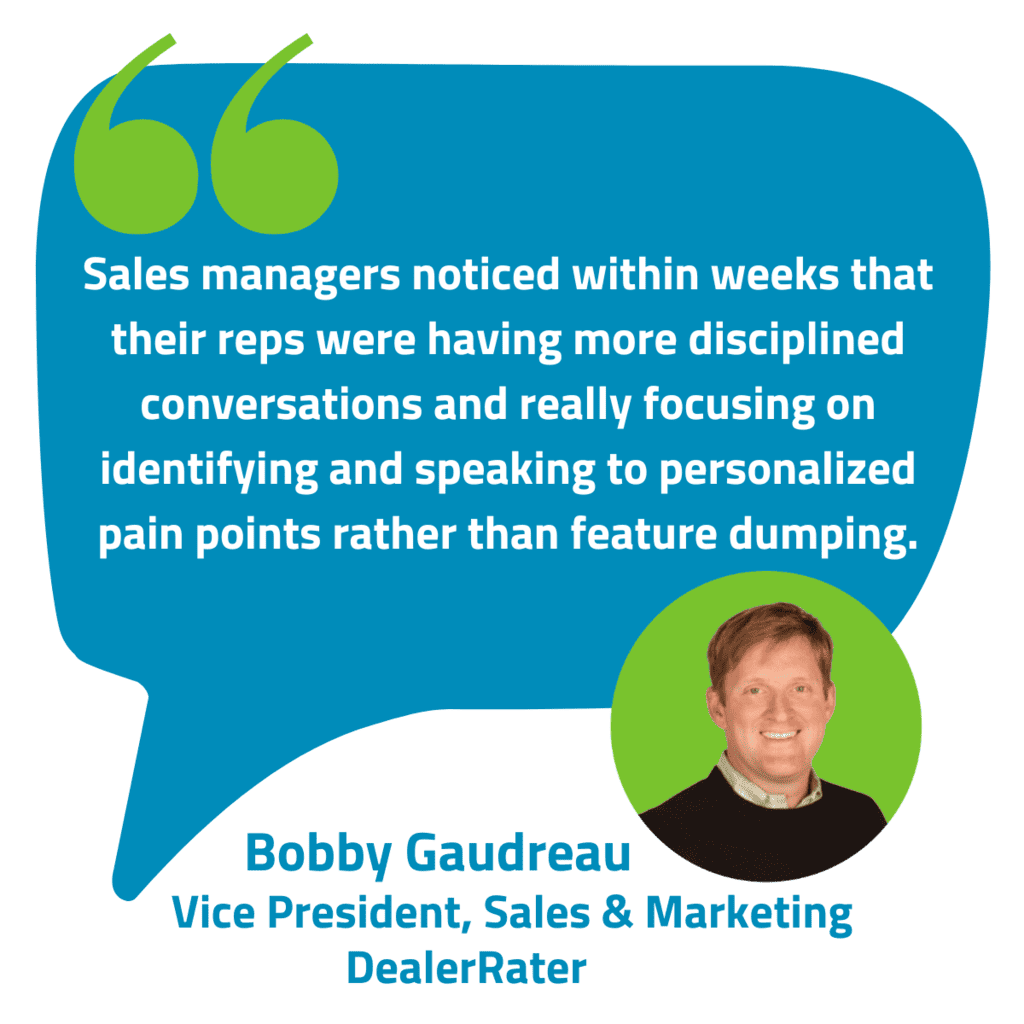

“Our work with Winalytics sharpened our sales positioning and execution to focus on a specific buyer business problem. Before, we focused too much on our own product and product innovation rather than on understanding how to make our buyers and customers more successful. Once we started to focus on the business ‘why,’ the impact on sales productivity was immediate and dramatic.”

eBook

Retail Industry

Buying Momentum

Training for Adapting to Changing Consumer Expectations

Get the data on top trends related to training for Academic Success and Retention and how to personalize your value prop to Higher Education learning buyers around their top-of-mind concerns.

Pockets of buying momentum

![]() Trends and key takeaways

Trends and key takeaways

Four key areas of concern![]()

Corporate Learning personas![]()

Discovery themes and questions![]()