Customer Success, like Customer Service, sits in the post-sale phase of the buyer journey, but the two teams engage customers in very different ways. Some companies make the mistake of blurring the lines of responsibility between Customer Service and Customer Success. Even those companies that embrace the distinction between the two teams and recognize Customer Success as a revenue center critical to renewals, however, often miss the opportunity to use Customer Success as a strategic driver of new revenue growth.

Customer Success, like Customer Service, sits in the post-sale phase of the buyer journey, but the two teams engage customers in very different ways. Some companies make the mistake of blurring the lines of responsibility between Customer Service and Customer Success. Even those companies that embrace the distinction between the two teams and recognize Customer Success as a revenue center critical to renewals, however, often miss the opportunity to use Customer Success as a strategic driver of new revenue growth.

Customer Service vs Customer Success

Customer service teams are tactical and reactive. Their job is to train new customers and walk customers through the tactical steps of getting their account set up. On an on-going basis, Customer Service reacts to customer issues and problems that are stopping the customer from getting value from a product. They also respond to questions and inquiries about how to use a product or service.

Customer Success, by contrast, should be proactive and strategic, focusing on aspects of a product or service that can help a customer meet business goals. They consult with customers to develop a full understanding of the customer’s business challenges, needs and goals. They leverage this understanding of goals to be proactive in managing customer relationships, sharing use cases, benefits or features that can help the customer meet their challenges and achieve their goals.

Customer Success as a Strategic Growth Driver

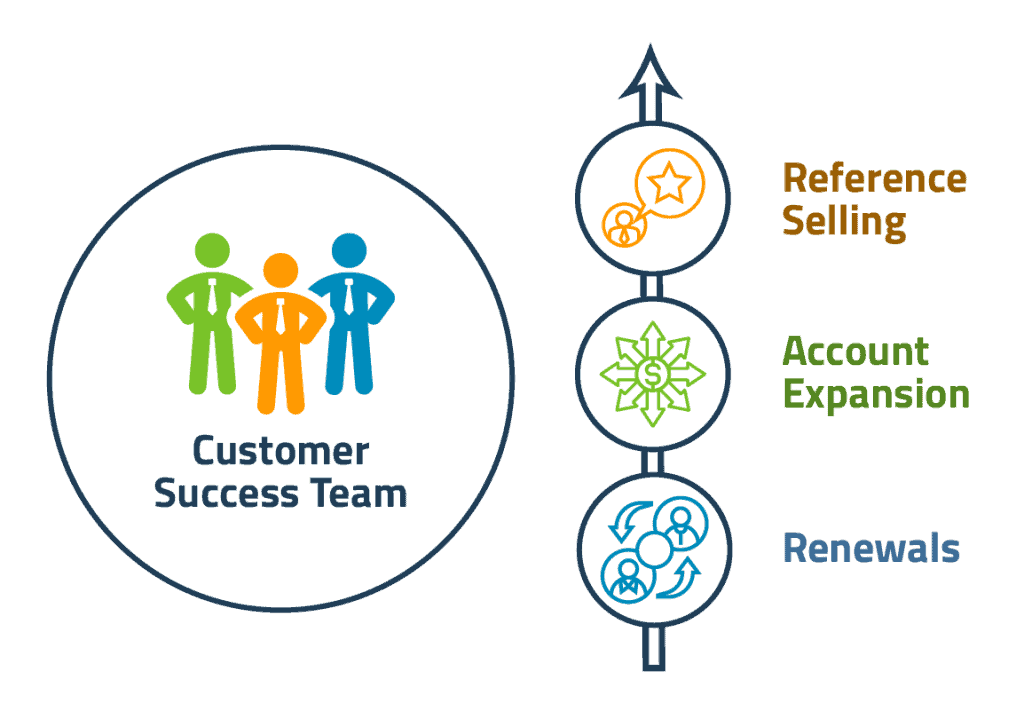

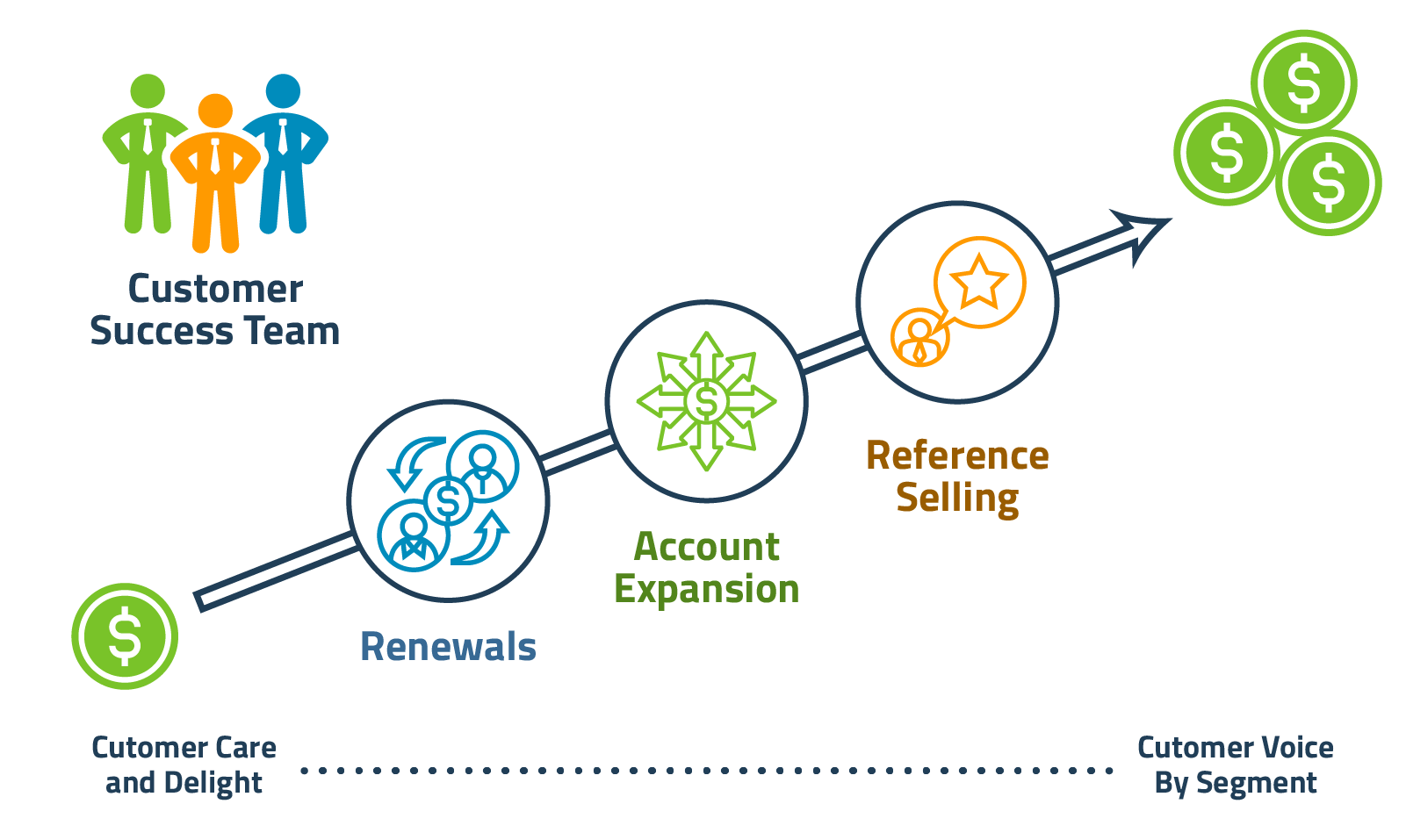

Most companies dramatically underutilize the proactive and strategic potential of Customer Success by limiting this team’s focus to securing high renewal rates and incremental upsells. Renewals are no doubt critical to consistent growth. However, Customer Success can begin to transform a company’s growth trajectory when it focuses on developing a specific customer voice by market segment.

The buyer goals, use cases, and payoffs that thrill and delight customers are different from one target market segment to another. Even the language buyers use to describe goals and payoffs can be different. Capturing the customer voice specific to each target market segment leads to both higher account values and faster growth in target market segments.

The Emergence of the Customer Success Role to Focus on Renewals

The growth of the customer success role has moved in lockstep with the growth of the “subscription economy,” a term coined by Tien Tzuo, founder and CEO of subscription-management platform company Zuora. The subscription economy started with “software-as-a-service” (SaaS) in the late 1990s as software companies moved from a pricing model that focused on a large upfront license payment and smaller on-going annual maintenance fees, to annual software subscriptions. After the subscription model took hold in software over more than a decade, it then started to take hold in business services like accounting, training and benefits, as well as in personal services like home cleaning, personal styling and pet care. Now we see subscription models across the consumer landscape, with subscription options for every kind of consumer good from candy to clothes to cigars.

In a subscription-based business model, a high renewal rate is among the strongest single indicators of the health and profitability of a business. Customer Success was developed as a key revenue center on equal standing with Marketing and Sales to manage customer renewal. By tracking individual customer satisfaction, engagement and utilization, Customer Success could help companies proactively manage to a higher renewal rate. Proactive management means identifying and reaching out to customers with a higher risk of not renewing, confirming and troubleshooting key customer priorities and looking for incremental upsell opportunities.

To understand the importance of renewal rates to growth, we can do a mental experiment on three companies that are almost exactly the same except for their customer renewal rate. Let’s call these three companies, Company A, Company B, and Company C. All three sell the same product into the same market, have the same cost structure across Sales, Marketing, Customer Success, Product and Operations and each successfully adds $1 million in new customer revenue each year for five years.

The only difference between the three companies is that Company A has a 90% renewal rate, Company B has an 80% renewal rate and Company C has a 70% renewal rate. That difference in renewal means that at the end of five years Company A achieves $24.7M in revenue, Company B reaches $18.8 million and Company C lags behind at just $14.2M. Company A not only grows 74% faster than Company C and 31% faster than Company B, but also is significantly more profitable.

Beyond Renewals: Building the Customer Voice by Market Segment

The work of Customer Success on renewals is clearly critical to growth. However, the activities used to thrill and delight individual customers and the activities used to build a customer voice by segment are not the same.

To effectively build the customer voice in each target segment, Customer Success and company leadership need to prioritize having team members roll up from their day-to-day work supporting customer usage and satisfaction to focus on the strategic work of identifying cross-customer patterns.

Finding the right customer voice in each target market segment means identifying patterns across a handful of top customers in each segment. It means identifying the recurring themes around important goals and use cases, the specific language customers use to describe these goals, and specific examples of the most successful customers in the segment. The customer examples should include target payoffs or outcomes that resulted from the customer’s use of the company’s product or service.

Only Customer Success is in a position to capture this voice of the customer in each target segment. This knowledge can come directly from their work focusing on implementing and training new customers, helping these customers to broadly deploy a new product or service, and making sure that the customer is unlocking all product or service benefits.

Working Jointly with Marketing

As they work on building the voice of the customer, Customer Success needs to closely coordinate with Marketing to ensure consistency and maximize the organizational benefit. There are three key joint activities between Customer Success and Marketing:

As they work on building the voice of the customer, Customer Success needs to closely coordinate with Marketing to ensure consistency and maximize the organizational benefit. There are three key joint activities between Customer Success and Marketing:

- Confirming the most important target growth segments

- Building 3-5 success cases in each segment

- Committing to a regular joint review and revision cycle

The first key joint activity between Customer Success and Marketing is confirming a company’s most important target growth segments. Target growth segments need to have a handful of strong, existing customers who are already evangelizers. These are customers who can act as strong advocates for the product or service, are willing to act as referrals, and have stories that can be shared as examples of successful client outcomes when engaging new buyers in the sector. Target growth segments also need enough other customers to build a segment growth pathway. Typically a target growth segment should have hundreds of other peers as potential buyers.

Having identified target growth segments, the second joint activity between Customer Success and Marketing is building success cases on three to five of the most successful customers in the segment. The success cases should capture the problem that the customer had, the range of use cases addressed by the company’s product or service, the outcome for the customer of working with the product or service and any specific quantitative impacts or payoffs. It is in writing down the use cases and payoffs for top companies in a segment where patterns around goals, use cases, and payoffs typically emerge. It is also in writing it down where variation in buyer language by market segment becomes easiest to identify.

The final step in building the customer voice by segment is committing to a revision cycle. The revision cycle should occur every 90 to 180 days. The revision cycle means that Customer Success and Marketing sit down together to pull out and revise their segment use case and payoff examples. The working session should focus on identifying new top customers in each segment as well as any new use cases for the existing top customers. The output of the working session is a revision of the segment roadmap of use cases and payoffs.

Customer Success as a New Revenue Driver

When Customer Success leads on building the customer voice by segment, it leads to two desirable revenue outcomes:

- Rapid account expansion through deeper understanding of buyer goals

- Faster segment growth through market-specific language, use cases and trust-building familiarity

With a basis of knowledge from the customer voice work, Customer Success can more deeply collaborate with Sales on faster account expansion based on better understanding of buyer goals. This rapid account expansion is the first important new revenue outcome from a strategic approach to Customer Success. In another post we looked at the role of the Mutual Success Plan in keeping customers, Sales and Customer Success aligned on linking revenue to buyer value. The Mutual Success Plan helps identify current buyer goals and payoffs as well as future payoffs.

Building use cases by segment means that Sales and Customer Success can use a Mutual Success Plan to continually position a company as a strategic partner able to solve multiple related problems for a potential buyer. Buyers hear goals and pains, discovery questions, capability talk tracks and customer success cases that are all developed from other buyers like them. They hear these segment-specific messages in the sales process, the onboarding process, and the on-going account review and relationship building processes. The repetition of segment-specific language makes it easier for a customer to understand and engage with expansion options.

Faster segment growth is the second new revenue outcome from building a customer voice by segment, improving reference selling and leading to faster new customer growth in target market verticals. Changes to key phrases, discovery questions, and talk tracks to build language specific to a target segment increases the buyer’s sense of familiarity in early discovery. New prospects may feel like “they were reading my mind.” In addition, written and spoken success cases that build on specific segment peers build trust faster. Buyers are most likely to engage when they hear from peer “evangelizers” that have had a strong experience with the company.

The work of Customer Success on building the segment voice extends its value even further by supporting both formal and informal peer reference programs. Informal peer referencing happens when a company writes down all of its buyers in a specific market segment or sector. These lists of a company’s “segment footprint” can be used in outreach emails or discovery call talk tracks to build quicker familiarity.

Formal referral programs involve directly asking buyers to identify peers for outreach. Usually this is done by asking a simple question such as “Which of your peers might be interested in learning about our work together? Or the success we’ve had together?” Formal peer reference programs may involve incentives or discounts, but often it is just satisfaction with being a leader in using a new solution that will motivate peer referencing.

Rapid Account Expansion: Parsable

When I think about great examples of using the customer voice by segment to drive account value, I remember immediately my conversation some months back with Lawrence Whittle, CEO of Parsable.

“We have a massive market opportunity for our manufacturing safety workflow application,” Lawrence opened as we started our conversation. “More than 80% of employees around the world do not work behind a desk – they work in manufacturing plants. This massive marketing opportunity presents a real go-to-market challenge.”

“Why a challenge?,” I said. “You guys started the market for digitizing safety workflows in manufacturing. How could a really big market be anything other than good news for you?”

“Well, the reality of our business is that while there are maybe 250 common safety use cases across all types of manufacturing,” he said, “there are thousands of industry-specific use cases in each type of manufacturing. It is the industry-specific use cases that have the most benefit to customers, create the largest account value and also create a ‘long tail’ to customer relationships.”

Parsable is a rapidly growing provider of digital workflow applications for manufacturing plants that improve safety, productivity and quality. The company’s Connected Worker™platform can replace thousands of paper-based work instructions that in the typical manufacturing plant sit on a shelf in six-inch binders. Plus, there is a huge amount of tacit knowledge in the heads of experienced workers that is not even on paper.

Parsable’s Connected Worker technology allows work instructions to fit right into day-to-day work of employees on manufacturing plant production lines. It works with any mobile device and operating system, and offers real-time, “how-to” guides with step-by-step instructions on any manufacturing operation in the plant. While this is powerful, the digital instructions are just the start. The Parsable application also collects a new set of human execution data on how work is being done and how manufacturing workflows can be improved.

“I see,” I said. “One focus area you mentioned is that your growth depends on a large number of use cases within each specific industry, so I assume you need a very clear way to continue expanding accounts after an initial sale?”

“Indeed. Having a really robust ‘land and expand’ model across Sales and Customer Success is absolutely key to our growth,” Larry said. “Our sales team focuses on identifying and selling 2 to 3 use cases where we can get to quick, measurable proof on the value, but they also focus on selling the vision of all the use cases we can help with by drawing on examples of work with other similar companies in the sector.”

“Typically we are looking to land a handful of use cases,” he continued. “Have an expansion phase 1 within 5-7 months, and an expansion phase 2 within 9-12 months. We want to triple use cases in the first year. We accomplish this with a team selling model across Sales and Customer Success to maintain the relationship over that first year. We also give the Sales team member who lands the initial deal a split of expansion revenue over 12 months.”

Already over $10 million in revenue, Parsable still doubled its revenues in a single year as it perfected its segment growth model. Working with an initial customer in an industry sector to continue to identify more use cases that could then be used to expand contract values across all customers in the segment was a key strategy contributing to the growth. Most companies would kill for a net revenue retention rate of 120% or more, meaning that their average customer renewal is worth 20% more than the year previously even including non-renewals. Parsable’s success in continuing to identify use cases for account expansion that could be sold across a segment led to a net revenue retention rate that was more than triple this best-in-class benchmark.

Faster Segment Growth: Plus Delta Partners

In thinking about how capturing the voice of the customer by segment can drive strong referral selling and segment growth, I can think of few better examples than Plus Delta Partners. Plus Delta Partners is a leading provider of professional development services to fundraisers in the higher education, non-profit, and medical fundraising fields. In contrast to the industry-standard workshop or e-learning based training, Plus Delta offers a 9-month longitudinal skills development program that combines team training, individual coaching and manager enablement.

On building segment growth, I am reminded of a discussion with Beth Nelson, Plus Delta Partner’s Chief Customer Officer.

“Early in the company’s history, we had a great list of liberal arts colleges and mid-sized private universities as referenceable brands,” Beth said. “We had really strong evidence that we could raise fundraisers’ productivity by 25% to 30% at places like Carleton College, Haverford College, and Loyola Marymount among others. But, these client names got us almost no attention from the large research universities, which have ten times the budget for professional development.”

“You now work with several dozen of the large public research universities like Michigan State, Ohio State, and University of North Carolina at Chapel Hill as well as top private universities like Cornell, Duke, and Rice,” I said. “So how did that evolution happen?”

“Well, it took us probably a year and half to land any research universities at all.” Beth said. “Fundraising leadership at these universities would get excited about our training approach, saying things like ‘we love that you focus on on-going skills development and coaching sessions rather than single day training sessions.’ And, then as we would get deeper into the conversation they would stumble imagining how our training model design for teams of 12 to 15 fundraisers would work with their teams of 100, 200 or 300 fundraisers.”

“Despite this objection, we eventually did find partners like Duke, Michigan State, and Nebraska who would ‘take a chance’ on us,” Beth said. “Then we looked at how these research universities actually used our training program. In each case, it was really about how they took our cohort model designed for 12-15 and focused on manager skill development. So, that allowed us to go to many other universities and talk about our program as a manager development tool that would help recruit and retain top quality manager talent and support the productivity of an entire fundraising team. Within a couple of years, we had dozens of research university clients.”

“That’s cool. Same product, different packaging and a big growth result,” I said. “Did growth happen the same way as you moved into medical fundraising?”

“Yes, it did,” said Beth. “There was a slight bit of product development we had to do since the focus in medical fundraising is on grateful patients and in college and university fundraising the focus is on alumni, but the product stayed 90% the same. But again it was mostly different positioning – a new skin on the same product.”

“In the case of medical fundraising, we had an easier time acquiring our first customers since many of our university partners had medical centers,” Beth said. ”And, once again, we watched how those first customers used the training program.”

“As it turns out,” she continued, “the thing medical fundraisers really wanted was to improve communication and collaboration between the senior fundraiser staff and their doctors. Medical fundraisers are typically very experienced and sophisticated fundraisers. They do not perceive that they need training, but they often have difficulty engaging and getting medical staff’s attention.”

“So, in this case it was almost an organizational skill rather than an individual skill set you were developing,” I said.

“As it turns out, yes. It was a lot easier to sell our program as fixing an organizational problem. If we sold our program as fundraiser skill development, the senior fundraisers would fold their arms and say ‘we don’t need this’”, Beth said. “So we sold it as an organizational solution and then used our cohort training model to train for individual skills in exactly the same way we did with colleges and universities.”

Plus Delta’s success in capturing the voice of the customer in these three very different fundraising segments helped it achieve 40%+ consistent year-on-year revenue growth for more than five years As it diversified from initial clients among liberal arts colleges and mid-size universities to research universities and medical centers, the company was very careful to build out success cases to validate its approach and ROI outcomes in each of these three core segments.

Assessing Your Customer Voice by Segment: A Simple Self-Diagnostic

Here are a few questions you can ask yourself to assess how effectively you are using Customer Success as a strategic growth driver:

- Is your Customer Success team expected to use work on individual account renewal and upsells to look at drivers of success across groups of customers?

- Does your Customer Success team work on identifying the goals, use cases, and payoffs that are most aligned to customer success within each target market segment?

- Does your Customer Success team identify differences in the words and language customers in each target segment use to describe their goals and target payoffs?

- Do Marketing and Customer Success work together to identify your most important target market segments and top customers in each segment?

- Do you have joint metrics in place for Customer Success and Marketing focused on segment velocity? Measures such as “number of referrals” or “% of customers who will give a positive reference” or “number of customers identified as segment evangelizers”?

In many companies, Customer Success is embraced as a revenue center and foundation for growth through its role in ensuring higher customer renewals and incremental upsells. However, the focus on Customer Success as a driver of renewal revenue has led many of these same companies to miss the opportunity to use Customer Success as a strategic driver for growth. Customer success starts to become a strategic growth driver when it looks beyond individual customer renewal and upsells to identify the patterns of use cases and payoffs for buyers in specific target sectors or market segments.