While they are all revenue-oriented teams, Sales, Marketing, and Customer Success each have their own personality and culture. Sales is stereotypically “coin-operated,” focused on putting points on the board and earning more incentive comp. Marketing is filled with “brainiacs” who can turn a clever phrase and also crunch numbers. Customer Success has those “nurturing” types who want to feed and care for customers.

While they are all revenue-oriented teams, Sales, Marketing, and Customer Success each have their own personality and culture. Sales is stereotypically “coin-operated,” focused on putting points on the board and earning more incentive comp. Marketing is filled with “brainiacs” who can turn a clever phrase and also crunch numbers. Customer Success has those “nurturing” types who want to feed and care for customers.

Most companies stop there. They say Marketing is good at identifying and engaging buyers, Sales is good at working deals, and Customer Success is good at customer care and account deepening. So, that’s what we’ll measure.

Unfortunately, focusing solely on team-level goals leads to slower revenue growth. It creates friction for buyers, who do the work of navigating hand-offs between your revenue teams, which in turn leads to fewer new opportunities, lower win rates on identified opportunities, and lost upsell opportunities. The better alternative is to supplement departmental goals with a set of cross-department goals that connect forward both your buyer goals and your company’s revenue goals from one revenue team to the next. This effectively shifts the culture from three revenue teams to one revenue organization.

A single, cohesive revenue organization is key to accelerating the pace of all revenue generating activities, from sourcing new opportunities to increasing account value to increasing the pace of market development in target market segments. As discussed in a separate Insight post on Buyer Value Pathways, building an integrated value messaging framework is one key to a cohesive revenue organization. The other is building cross-functional revenue processes and cross-department measurement to connect responsibility across Marketing, Sales, and Success for key drivers of revenue acceleration.

Building a B2B Revenue Organization: Zeel@Work

“I always find myself in these funny roles of needing to build a business-to-business revenue organization inside a company started with a consumer focus,” said Ben Robinson SVP of Sales at Zeel@Work, the B2B group for Zeel. “You have to be really good at getting business-to-business revenue teams executing as an integrated organization or you will just be lost in the noise of the more established, consumer-focused part of the company.”

Zeel helps its customers increase health and reduce stress with a range of services from high-quality quality massages to yoga, mindfulness and assisted stretching. Customers include individual consumers as well as employees who receive a health benefit from a Zeel partner company. Zeel@Work delivers employee wellness services both in-person and online to business customers as an employee benefit. The Zeel@Work team offers a compelling example of an integrated revenue organization.

“So, what is the biggest challenge?” I said. “Is it getting the whole revenue organization synced up? Is it around content and messaging or more related to buyer hand-offs?”

“Well, getting the Zeel@Work team synched up on messaging has been pretty straightforward,” Ben said. “Our team sells into corporate human resource buyers with messaging around ‘increasing wellness, decreasing cost.’ It is very similar messaging that our consumer team uses, which focuses on wellness as a path to a happier and healthier life. For us it was really just picking up well known research that employee stress costs US business $300B each year and that wellness programs can reduce healthcare costs by 86% and integrating it into our talk tracks.”

“OK, and what about the hand-off points and incentives? That must be different from the consumer side of the business,” I said.

“Yes, that took some work, particularly in the prospecting playbooks for the Marketing-to-Sales hand-off,” Ben said. “The first marketing campaigns run by the consumer marketing team really did not work at all for the business-focused sales team. We had way too much variability in leads, some good, some really bad. Since 70% of our leads are inbound, we needed to work closely with the consumer marketing team to optimize their lead generation efforts for our team.”

“How did you do that?,” I asked.

“We identified three target industries in technology, professional services and legal that were our ideal customers,” Ben responded. “These were the industries where the time from an initial discovery meeting to a closed partnership was twice as fast as other industries. After we identified these target industries, we then created ‘rules of the road’ for handing a lead from Marketing to our Inside Sales team to set first calls.”

“There were four rules,” Ben continued. “The lead had to be from a director or above, it had to be a business with at least 500 or more employees, it had to be in a geography we served, and it had to be in one of our three target industries.”

“So, that’s how you integrated from Marketing to Sales. How about from Sales to Customer Success, or the group responsible for onboarding and supporting your corporate buyers?” I said.

“On the success side, we did two things. The first is that we built our sales stages in our CRM to link Sales and Account Management. The Sales team member takes it from stage 1 or initial discovery call to stage 4 for closed won. An account manager then takes it forward into an account deepening phase.”

“We also changed incentives for the Sales team members,” Ben continued. “We moved to compensating sales on any upsell deal closed by an account manager within 12 months to motivate sales to do really good discovery on potential uses for Zeel@Work all over the business and hand off good notes. At first, my CEO was not a big fan. He called it ‘double dipping’, but as he saw the results come in he became more comfortable with the approach.”

“Last question,” I said. “When you are thinking about aligning the revenue organization, does that mean having Marketing, Sales, and Customer Success all reporting into someone in your role?”

“It could be organized that way,” said Ben. “In my last role, I had end-to-end revenue responsibility with a marketing, sales and customer success team. With Zeel, I currently have Sales and Customer Success. We draw on the central marketing, and expect to get our own marketing team when we get a bit bigger. More important than the organizational structure is that the three teams have incentives to focus on maximizing buyer value in the transition from one team to the next.”

Three Revenue Teams: Marketing, Sales and Customer Success

In my work with revenue leaders, I find that one of the very hardest tasks in creating a high growth culture is effectively aligning Sales, Marketing, and Customer Success to prioritize the buyer and the buyer’s journey across the revenue life cycle. To do this, revenue leaders need to develop processes, measures and incentives that support overall revenue goals rather than just individual team goals.

Challenges in Aligning Marketing and Sales

The tensions between Sales and Marketing have long been a topic of discussion. Some fifteen years ago Phillip Kotler, Neil Rackham, and Suj Krishnaswarmy wrote an article for the Harvard Business Review with a stark title, “Ending the War Between Sales and Marketing” and noting both economic and cultural conflicts between Sales and Marketing.

The classic tension is around lead quality. Marketers often want sales teams to work all leads being generated from content downloads to event leads to “hot” leads generated by demo requests. Sales people only want to spend time on well qualified leads. In the stereotypically dysfunctional revenue organization, leads are thrown over the wall from Marketing to Sales regardless of whether or not they fit with a buyer profile that is likely to be a good match for the company’s products and services. And, Sales, wanting to work leads with buying readiness, ignore a ton of potential customers that just need a little bit of education.

Another common challenge is around messaging. Marketers are highly analytical, data oriented, and have a project-focused working style. They tend to think in terms of building messaging that appeals to customer categories or segments. It feels high level and a bit abstract to sales people who focus on language that helps build excitement and commitment in individual buyer conversations. Rather than stick to marketing’s messaging, they feel a pull to respond, “yes” when asked “can your company help with this problem?” whether or not the problem is really a strength for the company.

Challenges in Aligning Sales and Customer Success

More recently, I’m seeing a lot more focus on integration at the other end of the buyer journey with many companies connecting Sales to Customer Success through improved hand offs. In a recent Harvard Business Review article by Andris A. Zoltners, PK Sinha, and Sally E. Lorimer called “What is a Customer Success Manager,” the authors note that more companies are shifting responsibility for ongoing customer care and growth from an account manager in a sales organization to a customer success manager who focuses first on customer interests and customer care.

The rise of customer success organizations is directly related to the rise of the subscription economy. The increasing importance of subscriptions across all business sectors has made renewal revenue and incremental upsell revenue a key driver of growth for a larger number of companies.

Customer Success first focuses on making sure that customers are fully unlocking the value of a company’s product or service and as a result have the deepest knowledge of what leads to successful customer outcomes. Whereas account managers within the Sales organization think about upsells, customer success managers focus first on customer loyalty and renewal.

In the stereotypical revenue organization, new customers who do close are thrown over the wall from Sales to Customer Success. Sales team members are the image of charm and attentiveness right up until the deal closes and then the customers are left to fend for themselves, often needing to re-educate their customer success representative on all the information shared in the sales process.

The Solution to Alignment Challenges: One Revenue Organization

In an increasingly buyer-centric world, more and more companies are seeing the need for a cohesive organization across all three customer-facing revenue teams. Without a unified revenue organization, buyers are left to navigate on their own the transitions from Marketing to Sales and from Sales to Customer Success. Friction for buyers from having to navigate the hand-offs between revenue teams leads to lost opportunities, lost deals, lost renewals and lost upsells.

In an increasingly buyer-centric world, more and more companies are seeing the need for a cohesive organization across all three customer-facing revenue teams. Without a unified revenue organization, buyers are left to navigate on their own the transitions from Marketing to Sales and from Sales to Customer Success. Friction for buyers from having to navigate the hand-offs between revenue teams leads to lost opportunities, lost deals, lost renewals and lost upsells.

One increasingly common approach to building a cohesive revenue organization is designing the C-suite to include a Chief Revenue Officer (CRO). The CRO role is responsible for all revenue-generating departments from Marketing, to Sales and Customer Success. The CRO is a relatively new role, emerging in Silicon Valley in the late 2010s but is growing rapidly. A quick search of the number of job listings for executive-level Chief Revenue Officer (CRO) roles with end-to-end revenue responsibility versus SVP of Sales or Chief Sales Officers with responsibility only for sales revenue suggests that CROs now account for almost one-third of job listings for the B2B revenue leader.1

Shifting to One Revenue Organization: Three Key Building Blocks

Whether there is an overall revenue leader of a single revenue organization or three separate revenue teams, there are three critical building blocks that need to be put in place to create a single, cohesive revenue organization. These are:

- A consistent messaging framework

- Cross-functional revenue processes

- A set of cross-team revenue processes that accelerate revenue velocity

The first critical building block is a consistent messaging framework, used by all teams, based on buyer value pathways. As discussed in an Insight post on Buyer Value Pathways, value pathways create an overarching concept of customer value across the revenue organization. Value pathways make it possible to create consistency in the buyer experience, with a common approach to buyer discovery and messaging around value.

The second key to building one unified revenue organization is shifting from department-level processes to cross-functional revenue processes. Cross-functional revenue processes means Marketing and Sales have joint responsibility for prospecting, Sales and Customer Success have joint responsibility for account value, and Customer Success and Marketing have joint responsibility for segment and market development.

Playbooks that guide buyer-facing interactions are one way to build cross-functional revenue processes, but they will have stronger impact on behavior when linked to shared measurement. So, the third important element of a unified revenue organization is adding to team-level measurement a set of cross-team measures that accelerate revenue velocity.

Department Processes vs Revenue Processes

Traditionally, Marketing, Sales and Customer Success teams are measured based on department-level activities that contribute to revenue generated. Marketing teams are evaluated based on engagement of new prospects and potential purchases. Marketing measures typically answer questions like “how many campaigns do they run to engage the market?” and “what is the rate of open, clicks, and downloads resulting from these campaigns?” Sales teams are evaluated based on success in sourcing and closing deals. Typical Sales measures look at “how many new discovery calls, new opportunities, proposals and closed deals?” Customer success teams are evaluated on customer satisfaction and engagement, with measures answering “what percentage of customers renew?”, “what percentage purchase an upsell?” and “what does this mean for overall account value?”

These department-level activity measurements are important to keep individual revenue teams effectively making their individual contributions. They do not, however, build deeper collaboration across teams to accelerate revenue velocity. And, in fact, they can make the problem of cultural conflict within a revenue organization worse by encouraging each team to focus on their specialization area.

Measuring Cross-Departmental Drivers of Revenue Acceleration

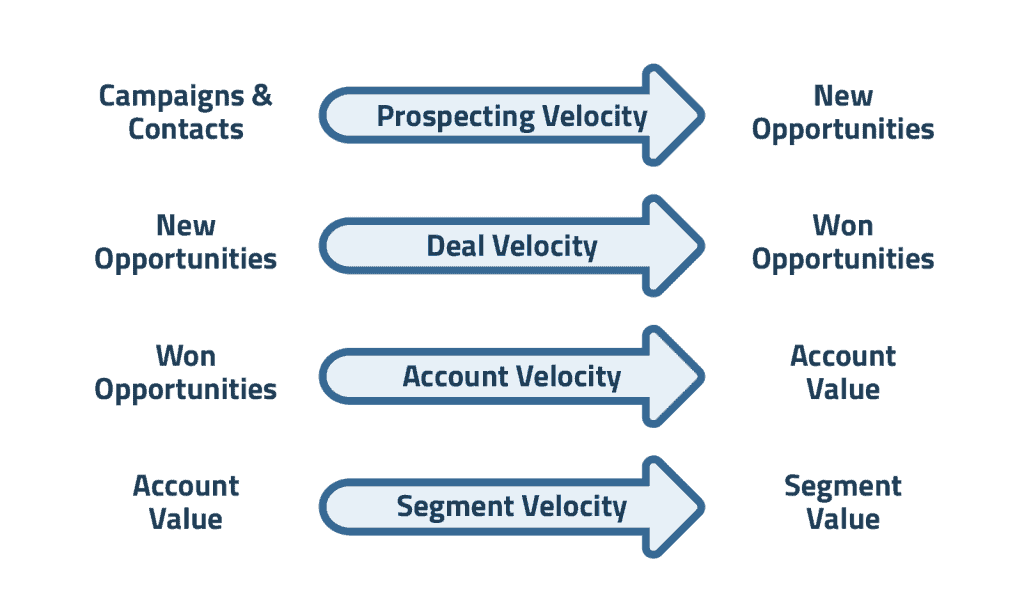

The key to building an integrated, cohesive revenue organization is adding onto the department-level metrics a new set of metrics that highlight key drivers of revenue acceleration across the three teams in the revenue organization. Revenue acceleration is driven by its four constituent parts: prospecting velocity, deal velocity, account velocity, and segment velocity.

Of these four key influences on revenue acceleration, deal velocity is the only measurement area that sits completely with a single revenue team, being owned wholly by Sales. The other three have important cross-departmental connections:

- Prospecting velocity connects Marketing and Sales

- Account velocity connects Sales and Customer Success

- Segment velocity connects Customer Success and Marketing

Prospecting Velocity

Prospecting Velocity Connects Marketing and Sales

Traditionally marketing teams focus on the volume of leads from a wide variety of sources, including website leads, content-driven leads, email promotions, webinars, and trade shows. They measure their success and want credit for “buyer engagement” that result from these activities – things like email opens, clicks, booth swipes, and website visits. These are all metrics that definitely build brand impressions and a company’s market presence, but may or may not generate actionable sales leads.

One of the best ways to accelerate revenue velocity is connecting Marketing and Sales by linking directly between traditional marketing activities and actionable sales opportunities. This means setting up ways to measure the number of new discovery calls and new deals coming from each 100 or 1,000 contacts in a campaign or engagement tactic. We call this prospecting velocity.

Marketing and Sales get better results in the qualified lead hand-off when they are both held accountable for prospecting velocity. Getting Sales and Marketing aligned on the impact of marketing campaigns on the generation of sales opportunities begins with agreeing on what constitutes a qualified lead. There are typically four key characteristics that need to be agreed on:

- Target titles or buyer roles

- Employee or revenue size of the buyer’s organization

- Market segment or sector focus

- A buyer action that demonstrates interest. This could be a commitment to a discovery call or demo, but it could also be a content download, participation in a webinar, or requests for information.

Getting to alignment on what constitutes a qualified lead, however, is hard to do in the abstract. Sales and marketing teams can sit together in a room and speculate on the right buyer role, size of organization, and target segments, but “best guesses” may or may not be accurate. Much better than relying on opinions is to generate actual market data. Ideally every quarter, Sales and Marketing are agreeing to a set of prospecting campaigns to test the market for ideal buyers.

When marketing campaigns are put in the context of 90-day test plans, it supports head-to-head comparison that makes it possible to generate evidence on which marketing activities result in the most sales opportunities. Each prospecting campaign becomes an opportunity to test a key goal area from the company’s value pathways against a key buyer title or buyer persona as well as key market segment or sector. Campaign tests can be set up for 90-days at a time with a monthly check-in meeting to review prospecting results and make adjustments to the campaign strategy.

Head-to-head campaign comparisons can focus on two key measures of prospecting velocity:

- The % of contacts by campaign that convert to an initial discovery call

- The rate at which initial discovery calls sourced from a campaign progress to a second call and/or to a sales-qualified opportunity (SQO)

Focusing on just leads, or even just on discovery calls, tells us little about the impact of marketing campaigns on a sales pipeline. It is only when we connect forward from leads through to SQOs that we really get an understanding of the marketing team’s impact on a sales pipeline.

Account Velocity

Account Velocity Connects Sales and Customer Success

Sales teams are traditionally measured on deal velocity, which means the number of new opportunities they produce, the rate at which they win the opportunities and the value of the closed won opportunities. However, measuring success in closed deals does not encourage sales teams to think about maximizing buyer engagement value. For the sales team, connecting forward to build an integrated revenue organization means focusing not just on the first close, but also on the timeframe to the first upsells and the overall increase in account value in the first 12 months after the initial close. We call this account velocity.

Measuring account velocity changes the relationship between Sales and Customer Success. No longer is the focus in Sales to do an initial discovery to get an initial deal closed that will be handed off to Customer Success for care and renewal. Instead the focus shifts to doing as deep a discovery as possible during the sales process to identify and hand off to Customer Success multiple potential goal areas that will support not just a first closed deal but also future potential deals. Handing off second, third, and fourth goal areas provides Customer Success with rich information that can support upsell opportunities that both expand customer value and expand account value.

As discussed in a recent Insight post, a Mutual Success Plan is a key playbook tool for both Sales and Customer Success to balance urgency in landing an initial sale with keeping open later upsell opportunities. A good mutual success plan keeps three key parties – customers, sales teams and customer success teams – aligned on linking revenue to buyer value by identifying and then prioritizing a range of goal areas that support a successful partnership. The Mutual Success Plan encourages better customer hand-offs, a stronger onboarding, and deeper connections to key influencers and decision-makers in the buyer’s organization.

There are three key measures of account velocity that can keep Sales and Customer Success consistently implementing mutual success plans and effectively transitioning customers from Sales to Success. These three are:

- Time to the initial upsell

- Total upsells in the 12 months after the initial close

- Total account value at the 12- and then 24-month point of the relationship

Segment Velocity

Segment Velocity Connects Customer Success and Marketing

Customer success teams are typically measured on customer satisfaction, utilization, renewals and incremental upsells. Given the importance of renewals to company growth, this focus makes sense. Three companies that are exactly the same except for having renewal rates at 70%, 80% and 90% renewal will experience dramatic growth differences.

Over a five-year period a company with a 90% renewal rate grows 74% faster year over year than a company with a 70% renewal rate and 31% faster than a company with an 80% renewal rate. At a 70% renewal rate, a company struggles to cover its sales and marketing costs. At a 90% renewal rate, there is free cash flow to invest in sales, marketing, or product innovation.

While a customer success team’s work on renewal and incremental upsells is critical, Customer Success also has a critical role to play in identifying the buyer voice by customer segment and in building reference value and referrals that will engage other similar buyers. This work increases the pace of new customer growth in key target sectors or segments. We call this segment velocity.

Very few companies recognize or incent the critical role customer success can play in faster segment growth. Traditional customer success measures do not encourage Customer Success to identify the most successful customers in each target market segment who can build referrals and evangelize to other similar customers. Connecting forward for customer success teams means having Customer Success and Marketing aligned in developing strategies to accelerate specific segment growth.

As we’ve discussed in a different post, Success Stories, whether written or spoken, are most effective when they engage a new buyer with a story of a peer organization that is exactly like this buyer. Success stories and lists of current clients organized by market segment are important elements of the prospecting playbook to drive first discovery meetings, the sales playbook to work deals to closed won, and the customer success playbook around land and expand.

Customer Success and Marketing are a lot more likely to consistently build success stories and current customer lists by segment when they are incented to do so around measures of segment velocity. A few measures that can be used to point toward segment velocity include:

- Referral rate, or the number of current customers overall and by segment who have made an introduction to a peer

- Referenceability rate, or the % of customers overall that would give a positive reference to prospective buyer

- Segment evangelizers, or the number of customers overall and by segment who have agreed to a case study, a testimonial, or to present as part of a company-sponsored webinar or event panel

HubSpot: Ahead of It’s Time

HubSpot, a well-known company that offers marketing, sales, and service software to help businesses grow, is a unicorn. They had the right market opportunity, the right team, and right timing. However, they were also way ahead of their time in the way they built their revenue organization to accelerate revenue growth. Ten years before Silicon Valley companies and venture capitalists started to move toward a Chief Revenue Officer, HubSpot was focusing on building end-to-end revenue processes.

“One key to our success was to focus on the customer endpoint,” Mark Roberge told me in a recent conversation. Mark was Hubspot’s SVP of Sales and Service and then Chief Revenue Officer from 2007 to 2016. “We answered the question ‘what is a good lead’ by looking at customer success and asking which customers had the highest lifetime value.”

“We started,” Mark continued, “by building our segmentation model around three personas – Owner Ollie for the less than 20 person company, Marketing Mary for the 20 to 200 person company, and Enterprise Erin for 200 to 2,000 person companies. We took these personas and intersected them with three phases of the buyer journey, including Problem Education, Solution Research, and Solution Selection, to include nine different buyer-person/journey combinations.”

“How did being more ‘scientific’ about getting to an ideal customer profile help HubSpot grow faster?” I asked Mark.

“It led us to do three things really differently than other companies at the time,” Mark said. “First, we did not focus just on the close rates on opportunities, but on revenue per customer to figure where to focus our sales and marketing investments. There is often not a direct correlation between leads that close at a higher rate and sales success. It is the close rate in combination with revenue per customer that shows the highest return on investments.”

“That makes good sense,” I said, “But how do you get your demand gen team to turn off the leads from the less productive segments? They usually want to get credit for all leads.”

“Your instincts are right and that was an area of learning,” said Mark. “The first BDR, or business development rep, compensation plan at HubSpot was on how many meetings they set for sales executives, and it was awful. If a sales executive was at or above plan, they would praise the heck out of the discovery meetings coming from their BDR, and if a sales executive was below plan, they would blame the low quality of the discovery meetings.

“That plan was a blunt instrument,” he continued. “So, we changed the compensation plan to focus not on meetings but on productive meetings and made revenue and customer lifetime value key drivers of the BDR compensation.”

“OK, that explains how you build alignment on revenue production at the front of the pipeline,” I said. “How did you handle the other key element of lifetime value, which is the pace of upsells and cross-sells?”

“Good question,” Mark said. “And there is a funny story in that. To build account value, I told my sales team that they would get paid 20% more on expansion revenue than the first revenue. They said to me, ‘Mark, you are crazy, you are going to encourage us to tee up a 100-seat sale and only close initially on 3 seats.’ And, I responded, ‘go for it!’”

“That’s exactly what I wanted them to do,” he continued. “That’s how the buyer wanted to buy. This approach kept opening sales cycles low and close rates high. And most importantly, it didn’t put a 100-seat account at risk. If the pilot didn’t work, we only churn 3 seats. If the pilot goes well and we upgrade to 100 seats, there is a high probability they will stick around for the long term. I wasn’t trying to turn AEs into CSMs. I was just trying to incent them to conduct the sales steps and set proper expectations to maximize the chance that these pilots and eventual expansions happened successfully.”

Mark’s focus on identifying a clear value prop around buyer microsegments and then aligning incentives for revenue velocity across the prospecting, sales and customer success organizations helped HubSpot grow from $0 to $100 Million in revenue between 2007 and 2013 as they acquired more than 10,000 customers in 60 different countries.

Assessing Your Revenue Organization: A Simple Self-Diagnostic

Here are a few questions you can ask yourself to assess how well you are supporting your revenue teams in accelerating revenue and working as one revenue organization:

- Do buyers get handed off from Marketing to Sales, and from Sales to Customer Success, in ways that reduce friction for buyers and help them navigate transitions smoothly? Do these hand offs explicitly support future revenue acceleration?

- Do your revenue teams – Marketing, Sales and Customer Success – think of themselves as a revenue organization? Do you have an organizational structure, such as a CRO or close departmental alliances that support a “one revenue organization” approach?

- Is there a consistent messaging framework across Marketing, Sales and Customer Success based on buyer value pathways?

- Do you have joint metrics in place for Marketing and Sales focused on prospecting velocity? Measures such as “% of contacts that convert to discovery calls” or “rate of conversion from discovery call to SQO”?

- Do you have joint metrics in place for Sales and Customer Success focused on account velocity? Measures such as “time to initial upsell” or “total upsells within 12 months of initial close” or “total account value at the 12-month or 24-month point after initial sale”?

- Do you have joint metrics in place for Customer Success and Marketing focused on segment velocity? Measures such as “number of referrals” or “% of customers who will give a positive reference” or “number of customers identified as segment evangelizers”?

Most CROs and revenue leaders know Marketing is good at identifying and engaging buyers, Sales is good at working deals, and Customer Success is good at customer care and account deepening. They also know that all three teams make critical contributions to revenue growth and velocity, but fail to put systems and measures in place that explicitly support maximizing revenue velocity. The key to revenue optimization is shifting the mindset and supporting metrics so all three revenue teams – Marketing, Sales and Customer Success – operate as one cohesive revenue organization.

__________

1 Chief Revenue Officers: 861 on Glassdoor and 2225 on Indeed; SVP of Sales/CSO of Sale : 1419 (652 + 587 +80) on Glassdoor, 4678 (2495+1959+224) on Indeed