CEOs and revenue leaders often ask me “What is the most important thing I can do to drive sales revenue more consistently?” My response is always the same: “Train your sales team to start and end every sales conversation on buyer goals and payoffs.” If you anchor deals on buyer-defined value, you win the hearts and minds of your buyer. The best selling goes even further and translates that buyer-defined value into a specific, agreed-on payoff to justify the financial investment.

Despite knowing that a focus on goals and pains build greater buyer engagement, sales representatives often drift back to a focus on product and can forget to re-establish the link between the product and the buyer’s target goals and payoffs. As I write this, I am reminded of a recent conversation with a top sales representative on Burning Glass Technologies higher education team.

Burning Glass is the world’s leading labor market analytics company and provides real-time data on jobs and skills trends to companies, governments, and colleges. Real-time data is compiled by scanning 40,000 sources of job postings daily. At any given time, the system tracks about 3.4 million unique, currently active openings.

Let’s call this top sales representative Stacey. Stacey was sharing a recent prospect call with me, saying “The Arkansas State University call was great. They were impressed with our platform. They were ‘wowed’ that they could see exactly how many graduates they had for each degree program, their main competitors for each degree program, and degree connections to specific employers and jobs.”

I responded, “That’s good news that they found the product impressive. I remember in your very first discovery call, you did a great job of surfacing their concerns about tuition revenue and financial stability risks. I remember you shared that they were looking for ways to both attract new enrollments and to retain existing students. Did you have a chance to learn more about their specific goals in each area? And, to validate they saw the Burning Glass platform as helping them to achieve these goals?”

She grew quiet and then blurted out, “Shoot! I totally forgot to revisit those goals and payoffs as we had discussed. They were just excited about the platform and kept asking to see more workflows and data pull, and I lost track of time. Before we knew it we were at the end of our time. I will follow up by email to see if I can confirm their specific enrollment and retention goals.”

Stacy’s experience with Arkansas State demonstrates the constant challenge of staying focused on buyer goals and payoffs throughout the sales process. It’s difficult, even for top sales reps, to resist drifting back into d product pitching. Strong business growth, however, comes from business value delivered by a product, not from the product itself.”

Why Sellers Fall Back on Product Pitching and Why That’s a Problem

The drift back towards product pitching has a number of causes. Buyers are often quick to ask for more details on a product or to insist that they need a product demonstration. Sellers are often most comfortable when discussing their product. They have their standard talk tracks on all the key features and benefits worked out and know exactly what to say. Conversations on buyer goals, by contrast, are fluid and can be unpredictable.

Sellers representing new or transformational products like immersive virtual reality, AI-based personalization engines, predictive risk modeling, and data-driven business insight engines are particularly prone to get caught up in product discussions. There is a lot the buyer is unfamiliar with so they ask a lot more product questions. Sellers may also want to show off the “wow factor” or the “product sizzle” — those things their product can do that no other product can touch.

The problem with drifting back to product is that it leads buyers to disengage. Forrester Research did a study titled “Why Don’t Buyers Want To Meet With Your Salespeople?” that highlights this failure in stark terms. The business executives in the study said that 60% of salespeople they meet are very knowledgeable about their own products and company, but less than 25% of salespeople are knowledgeable about the buyer’s key business issues or able to present relevant use cases or case studies.

The outcome of this focus on product is that many buyer conversations are dead on arrival. According to Forrester Research, only one in four of these salespeople get agreement from executive buyers to meet again. Aberdeen Research has a related finding that only 37% of initial discovery calls with buyers at any level result in a follow on meeting.

When our buyer conversations focus on our product, buyers’ typical takeaway from a meeting focus on the gaps around our product. It becomes pretty easy for them to move onto their next meeting and forget about us altogether. All products, no matter how compelling or “transformational” have limitations. Some of these limitations are functionality gaps around things the product simply does not do. Other limitations are competitive gaps around product features that are less compelling than alternative products, or they are process or technology gaps around ways the product may not neatly fit into the buyer’s organization.

Shifting the Focus to Buyer Value

On the other hand, when we center our sales conversations on a buyer’s Values Pathways, meaning their goals and payoffs to achieving those goals, it flips the switch. When we start each buyer conversation on their Value Pathways focused on their goals and capability gaps to achieving those goals, it raises awareness about known and unknown costs of not solving the gap. When we share scenarios for fixing the gap and move the buyer toward their goal, it creates hope that there might be a bright future.

When we explore the payoffs, both personal and organizational, it lessens the inertia around a change in a business process and starts to make that change feel like it might just be an opportunity to be a “hero to my team, coworkers, and boss.” A buyer’s most likely takeaway from a meeting focused on their goals and payoffs is going to be the desire for additional conversation. Teams that run their first meetings around buyer goals and payoffs rather than product see their initial discovery calls progress to second and third meetings at an average of 60%-65% rate, almost double the industry average of 37%.

Anchoring on Buyer Value: Five Expectations to Set for Your Team

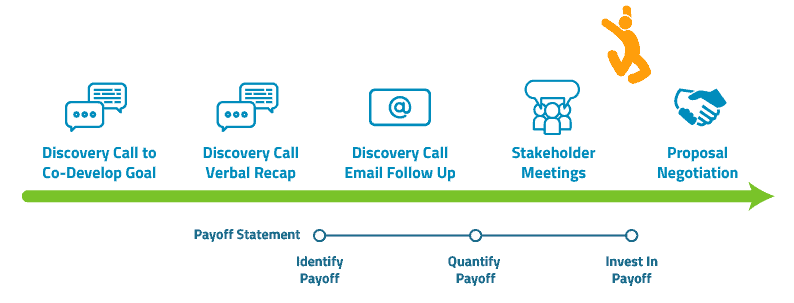

So, how do we get teams to consistently anchor and re-anchor their sales conversations on buyer goals and payoffs? The best approach is to coach your team on how to manage their prospect meetings with a focus on building a continuous conversation across all meetings. To ensure these conversations anchor on buyer value, here are five expectations you can create for your team:

#1 – Start each meeting with value discovery on buyer goals

#2 – Revise and refine target goal achievement to let buyers define value

#3 – End each meeting with a verbal recap of specific goals and a payoff

#4 – Follow up with an email recap of agreed-on goals and payoffs

#5 – Quantify the potential payoff to justify a budget investment

Expectation #1: Start each meeting with value discovery on buyer goals

The first expectation is that each meeting starts with value discovery on buyer goals. The first 5 to 10 minutes of each prospect meeting needs to focus on establishing, confirming, or getting more detail on the buyer’s goals and payoffs. It does not matter whether it is a first, second, or third meeting, a meeting with a single buyer or a group discussion with a set of stakeholders in the buyer’s organization, or a final proposal call. In each and every meeting, we need to commit to discovery and confirmation on buyer goals.

In a first meeting, we do initial value discovery on those goals and payoffs, touching on a range of different goals, issues and priorities to find all that could be important. In follow-on meetings, we open by re-confirming what we have already heard about goals and ask for additional input. We ask which of the goals discussed so far are most important. We ask if any of the goals discussed are on their CEO’s or executive team’s priority list, in the year’s strategic plan or in the product roadmap. We ask if any of the goals have specific targeted improvements that might make it easier to invest in a partnership.

Expectation #2: Revise and refine target goal achievement to let buyers define value

The second expectation is to revise and refine target goal achievement to let buyers define value throughout each meeting. Buyer goals and payoffs need to be continually co-developed with the buyer. When we present our understanding of buyer goals at the beginning of a meeting, we need to stop to confirm that our understanding is correct. When we discuss our product, we need to stop to confirm that buyers on the other side see a direct connection between our product and their goal achievement. When we have agreement on targeted goals or improvements, we need to establish the payoff to individual buyers and the organization of goal achievement.

Product always comes up in conversation and that’s natural. Buyers need to directly experience the power and uniqueness of any product. However, once it becomes all about the product, a seller can quickly lose momentum in a series of detailed questions about what a product can and cannot accomplish. So, every time that we discuss our product, we need to bring the conversation back to how our product helps with the buyer goals and payoffs. It is the goals and payoffs, not the product, that will justify a financial investment.

Expectation #3: End each meeting with a verbal recap of specific goals and a payoff

The third expectation is that each meeting should end with a verbal recap of specific goals and a payoff. Every sales meeting should end with a summary of our potential value to the buyer. It is a quick recap and confirmation of what we have learned during the call about their goals, desired improvements, and what is most likely to lead them to invest time and eventually financial resources in a relationship with us. The buyer’s response to our verbal recap is the single quickest way to gauge the strength of the buyer’s interest in working with us.

Expectation #4: Follow up with an email recap of agreed-on goals and payoffs

The fourth expectation for every meeting is to send a follow-up email recap of agreed-on goals and payoffs. It sits with the seller to re-cap for the buyer all the vital outputs of the meeting, including potential goals for a partnership, their gaps and our capabilities to meet these goals, and what comes next. The follow up email is our primary sell-through document. It helps the buyers in direct conversation with us and also communicates goals and payoffs indirectly to other decision-makers in their organization.

Expectation #5: Quantify the potential payoff to justify a budget investment

The fifth and final expectation is that we quantify the potential payoff to justify a budget investment. In our discovery meetings, we confirm a buyer’s goals and payoffs to them individually or to their organization of advancing that goal. As the sales process moves into meetings with more decision makers, it is important to get very specific about the potential payoff. This can involve asking questions if there are any targeted improvements in a goal area, the level of improvement that would be required to justify an investment, or, more simply, if there is a level of improvement that would get the buyer, their boss or their team excited.

Anytime a buyer agrees to work with a new vendor, they are agreeing to do things differently than they are being done currently. The buyer may have to introduce a new process, work tasks, patterns of communication or some mix of all three. And, they will have to pay the vendor for the privilege of making this change. For a buyer to get out of their comfort zone and shift from the known to the unknown there has to be clear payoff. The sooner we can identify that payoff and then quantify the potential impact on their organization, the higher likelihood of getting to financial commitment to support a purchase.

Anchoring Deals on Buyer-Defined Value Drives Sales Growth: Credly’s Problem Finding

Credly, the company that created the category for digital credentials and badging, offers a compelling example of the impact anchoring deals on buyer-defined value can have on sales growth.

“Our whole business culture is focused on the idea that the customer does not buy a product or a feature, but a solution to a business problem” says Jarin Schmidt, Chief Experience Officer at Credly when discussing the company’s approach to sales.

Jarin is not the most likely of entrepreneurs, having come to Credly in 2018 from the corporate behemoth Pearson Education as part of Credly’s acquisition of Pearson’s badging business called Acclaim. Jarin was part of the founding team of the Acclaim product line and had been working for five years to incubate the badging business within Pearson.

Credly was a nimble start up with just 20 employees prior to the acquisition of Acclaim. Pearson Education was a long-established business with more than 30,000 employees in a variety of divisions focused on educational publishing, assessment, and professional training. Prior to joining Credly, Jarin had spent more than 17 years working in various roles at Pearson, including five years on the Acclaim team.

Jarin continued, “whether it is a big or small company environment, at the end of the day business growth is all about ‘problem finding.’ In the years working on digital badging at Pearson, I had gotten really good at problem finding for a variety of talent management challenges that digital badging can solve. I knew the market opportunity was huge.”

“Say more about that,” I responded, “what do you mean by problem finding?”

Jarin said, “It was not just that there was this abstract idea of creating a credential for professional skills. There were some very specific business challenges that resulted from not being able to document skills. Getting better at certifying skills could, for example, improve new employee recruiting, increase employee retention with better internal career paths, support higher training completion rates, and increase brand awareness among passive candidates. So, in my conversations with corporate and higher education buyers, I could always find some very specific business challenges to motivate a partnership.”

“Well,” I smiled, “clearly your instincts were on target because if I have my numbers right you have seen more than 100% increase in customers year over year since Acclaim was spun out of Pearson and you are signing up alot of top brands, like KPMG, DocuSign, and Tableau.”

I added, “But, you did not personally sell all customers. How did you make ‘problem finding’ repeatable? So often, the early leaders’ vision and instincts fail to take hold in a sales team.”

Jarin said, “We trained all of our sales team members to start prospect conversations by sharing a ‘buffet board’ of common use cases and then let the buyer identify the most important use cases and scenarios that could support a partnership.”

“Then as we moved deeper into the sales process,” he continued, “we would ask the buyer to share specific goals around say talent recruiting or talent pipeline and internal career paths or validating skills. Their goals might be related to wanting more employees to complete training or increasing their employer brand to more passive job candidates not actively looking for a job. We found that buyers with specific goals were typically a lot more motivated purchasers. We also wanted to see if they were working on a problem that we had already solved and documented in one of our case studies. This made it alot easier to build the budget case for investment. We already had clear evidence that we could have a business impact.”

Credly created a growth juggernaut by having its sales team start each prospect conversation focused not on their product but focused on having buyers identify their top problems that digital badging could solve and then working toward a specific payoff to solving this problem. Most sales professionals fail to use this very simple technique, but anchoring deals around buyer-defined goals and meaningful payoffs leads to higher buyer engagement and increased win rates.

Assessing Your Readiness to Anchor on Buyer Value: A Simple Self-Diagnostic

Here are a few questions you can ask yourself to assess how well you are supporting your team in continuously re-anchoring on buyer value throughout the sales process:

- Do you coach your sellers to focus on value discovery and value mapping as the first priority in initial calls with prospects?

- Do you set specific expectations for sellers to re-anchor on buyer value at the beginning and ending of each and every buyer meeting?

- Are sellers armed with “problem finding” use cases to help them through discovery? Do you prioritize this as much as providing them with product and feature info?

- Are sellers systematic about identifying buyer payoffs to justify financial investment in a partnership? Do you coach them on this?

- Do your sellers focus on confirming buyer-defined value and payoffs in follow up emails to ensure additional reach to indirect decision makers?

Most CEO’s, revenue leaders and sales people know that sellers should focus on value discovery early on in the sales process. But sliding back to the comfort zone of product pitching is all too easy. The best selling keeps the focus on buyer-defined value throughout the sales process. Sales leadership can help with a systematic set of expectations around deepening discovery and re-anchoring on buyer value and payoffs all the way through to the final deal.